Smart finance management can save you some extra cash, but managing money can be tricky. Thanks to new technology, there are now modern ways to manage your finances. You can find a plethora of expense tracker apps, both free and paid, but choosing the right one can be tough. Here’s a list of our recommendations.

These spending tracker apps give you complete control over your finances. Each of these apps comes with many cash-saving features and serves different purposes. I hope you find something interesting in the list. The best part is that these apps are available for both Android and iOS devices.

1. Mint – Smarter Way to Save More

Mint transforms how you manage your finances, making it one of the first applications on our list of the top spending tracker apps. The app consolidates your financial information into one location, including balances, budgets, credit health, and financial objectives.

It simply links with your bank accounts, giving you a real-time snapshot of where your money’s going. Additionally, it categorizes your spending so you can see at a glance where the cash is flowing. Moreover, it’s completely safe and works automatically, eliminating the need to enter the data manually.

One of the app’s nifty features is transaction tracking. It’s like your financial watchdog, as every time you swipe that card, it records and categorizes your expenses. Plus, the bill reminders on this app are lifesavers.

The expense tracker app also allows you to set your budget and keep you in check. It breaks down your spending so you can see where you’re rocking it and where you might need to tighten up. Moreover, it also tracks your taxes and checks your refund status and date estimate. The best part about the app is that it notifies you when you receive your refund.

Another standout feature of this app is the Billshark bill negotiation. It’s a premium service that can save you money on your monthly bills.

Pros

- Ability to set and track savings goals

- Handy loan repayment calculator

- Easily syncs with bank accounts and credit cards

- Timely reminders for payments

Cons

- Regular ads

- Occasional glitches

Price: Free; Subscription: $0.99/month onwards

Also Read: How to fix Android camera not working

2. Goodbudget – Cash Flow at Your Fingertips

Goodbudget stands out as a stellar choice among the best expense tracker apps for both iPhone and Android. The app has a simple and user-friendly interface that syncs your budget seamlessly across multiple devices and the web.

By keeping your transactions synced with the cloud and providing secure data backup, the app ensures that everyone involved stays on the same page about their finances. The app also offers insightful in-app reports, helping you analyze and modify your budget effectively and make informed decisions about your spending.

Let’s dive into features and their real-world applications. First up is the envelope system. It’s like having digital envelopes for different spending categories. The best part is that you can create envelopes for different purposes. Simply fill up that envelope, and when it’s empty, you know you’ve hit your limit.

We all have those lingering debts. This spending tracker app also helps you tackle them strategically with its debt payoff planner feature. All you need to do is plug in your numbers, and it creates a plan for you. It’s like having a financial buddy nudging you toward debt freedom.

The bill tracker is yet another feature you can find on this app. It reminds you when bills are due, so there are no more late fees. And for those unpredictable months, there’s the irregular expense tracker. Just enter your car repairs, birthday gifts, or other expenses, and Goodbudget ensures they don’t blindside your budget.

Curious about premium features? Goodbudget Plus offers perks like unlimited envelopes and syncing across devices. It’s $6.99 a month. Not bad for extra convenience, right?

Pros

- Detailed debt and expense reports

- Swift navigation

- Effective management of debts

- Budgeting based on envelopes

Cons

- Can enhance customization

Price: Free; Subscription: $6.99/month onwards

3. Money Manager – Keep Your Financial Secrets Safe

Managing household finances used to be a real puzzle, but not anymore! It will be smooth sailing with the Money Manager. This personal finance tracker app makes inputting data a breeze, and you can do it anytime, anywhere. The default settings are friendly enough to get you going, and when you’re ready, tweak things around with the customizable features that suit you.

One of the things that makes the app stand out is its excellent graphics, allowing you to see your spending habits in living color. The search and calculator functions are like handy sidekicks. Plus, stats are at your fingertips – punch in the numbers, and voila!

Moreover, the spending tracker app lets you handle multiple currencies and all your accounts in one place. This app lets you plan your budgets weekly, monthly, or annually. Not only this, but the app is also flexible, as it allows you to shift the month’s start date to fit your life.

Double-entry bookkeeping might sound fancy, but it’s another feature to make your account management efficient. Another thing we love about the app is that you can set up automatic money transfers between your accounts and configure the frequency of those transfers.

Now, let’s talk about subscriptions. The good news is Money Manager offers a solid package for free. However, if you want to level up your financial game, there’s a subscription option too.

The monthly subscription costs $2.49, while the annual plan costs $19.99. With the premium version, you can unlock additional features like advanced budgeting tools, detailed financial reports, and even more customization options.

Pros

- Access to reports on a weekly, monthly, or annual basis

- Visual representation for clearer understanding

- Support for multiple currencies

- Ability to set up separate accounts for expenses

Cons

- Limited features

- No support for managing income budgets

Price: Free; Subscription: $2.49/month onwards

4. Expensify – Paperless Expense Tracking

Looking for a reliable app to track your personal and business expenses? Expensify is the solution you need. The app makes tracking expenses a breeze, eliminating the need for manually inputting expenses.

You can snap a picture of your receipts and let Expensify do the rest. It automatically categorizes your receipts and lets you add custom tags to keep things organized. Ensuring everything is right at your fingertips when needed.

Moreover, if you’re always on the move, the spending tracker app will keep your flights, hotels, rental cars, and other expenses in check. Plus, with multi-currency support, your costs are covered no matter where you are in the world.

The makers understand that running a business means juggling a million things at once, so if you’re a business owner, Expensify has more to offer. With its multi-level approval workflow feature, the app ensures that they do the heavy lifting of your budget while your team stays happy and you stay focused on what matters.

The app also integrates seamlessly with top accounting tools like Xero, NetSuite, and Quickbooks. So you can also say goodbye to all the manual data entry work. Though the app is free to download, Expensify also offers a subscription to give you VIP access to hassle-free expense management, priced at $4.99 per month.

Pros

- Facilitates corporate travel bookings

- Expensify Card for convenient payments

- Built-in receipt scanner feature

- Ideal for large corporations

Cons

- Refund policies are subpar

- Get slow at times

Price: Free; Subscription: $4.99/month onwards

5. QuickBooks Accounting – Best Bill Manager App

Managing money can be challenging, but not for people with the QuickBooks Accounting app installed on their devices. This amazing tool lets you track your mileage and cash flow, generate invoices, snap a receipt, and much more. Thanks to the built-in money tracker, you can manage all your accounts effectively with this user-friendly money software by centralizing them in one location.

However, the app isn’t just pretty; it’s also packed with features that make expense tracking a breeze. We’re talking about categorizing expenses, tracking mileage, and even snapping pictures of receipts because who has time for paper clutter?

Two features that we particularly loved are automatic expense categorization and receipt scanning. Imagine you have a bunch of receipts, but you launch the QuickBooks app and take a snap of them or upload them, and the app automatically sorts them into neat categories, saving you from the tedious task of manual sorting.

So, have you ever wished your expense tracker could do more than count dollars? If yes, QuickBooks is the app for you because, whether you’re on a business trip or driving to grab your favorite coffee, this app logs every mile with its mileage tracking, and the best part is that it won’t drain up your battery.

Did we mention that the app comes with a 30-day trial? Moreover, if you’re looking for features like advanced reporting and automatic invoicing, you can enjoy them with the premium subscription starting at $9.99.

Pros

- Simple and user-friendly

- Works well with third-party apps

- Generates useful accounting reports

- Affordable pricing

Cons

- Integration issues

- Slow responsiveness

Price: Free; Subscription: $9.99/month onwards

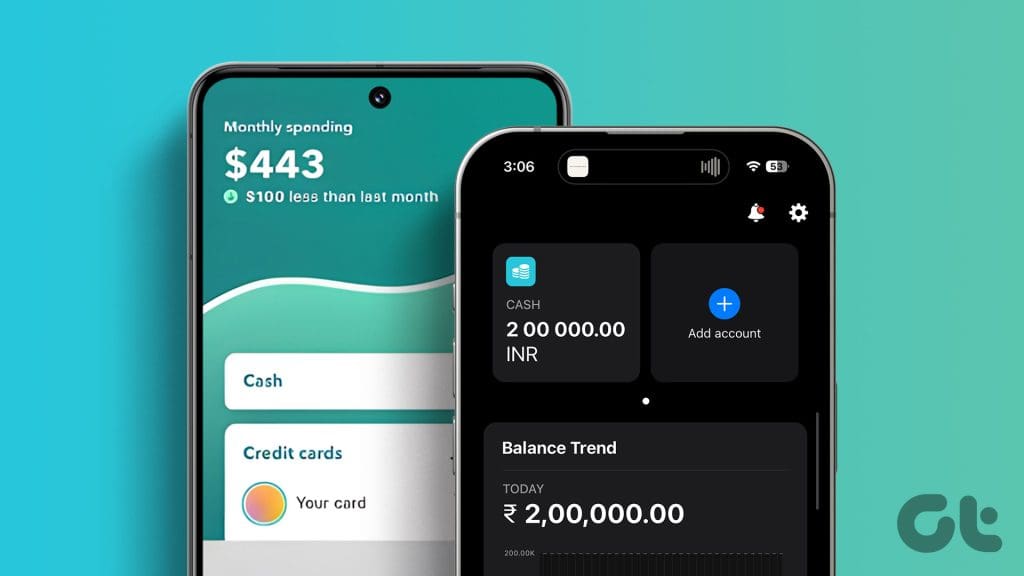

6. Wallet – Control Your Money From Anywhere

Wallet is a simple expense tracker app that helps you pursue your financial goals. The app collaborates with 4,000 global banks, allowing you to auto-sync your transitions, create flexible budgets, and track your spending. It can be considered your one-stop solution to track expenses, income, and everything else.

The smart assistant is one of the standout features of this free expense-tracking app. It analyzes your spending habits, warns you about potential budget breaches, and suggests areas where you can cut back.

You know how bills sneak up on you like a ninja? But not anymore, as the bill tracker gives you a heads-up, ensuring you’re never caught off guard. It’s a lifesaver for those who can’t remember where half their money disappears every month.

With the reports feature in the app, you can break down your financial life into easy-to-understand graphs and charts. Plus, the category management lets you see where your money is going.

The budget rollover is another feature that is a financial safety net for you. Guess what? If you didn’t spend all your designated money on a certain thing this month, it rolls over to the next.

You can use its premium version if you want to level up your budgeting game. It unlocks features like custom wallets, unlimited accounts, and the ability to export your data.

Pros

- Simple and user-friendly interface

- Allows individual categorization of expenses

- Helps track expenses quickly

- Automatically syncs transactions with banks

Cons

- Issues with syncing

- Limited features

Price: Free; Subscription: $5.99/month onwards

7. Rydoo – Popular Expense Tracker

Rydoo may be last on our list of the best expense tracker apps for iPhone and Android, but it is second to none. First off, we love how it keeps things simple and effective. It tracks your mileage automatically, saving you the headache of jotting it down manually.

This free expense tracker doesn’t stop at the basics. It hooks you up with currency conversion on the fly, which is handy for business, travel expenses, and more. Plus, it syncs up with your credit card, so you’re not stuck manually entering every coffee or cab ride.

Now, let’s talk about the app’s look and feel. The UI is as straightforward as your morning coffee order. Moreover, it comes with a cool feature that detects duplicate receipts. Plus, it integrates with your calendar, linking expenses to specific events. It’s like having a personal expense assistant.

It also has a nifty feature that lets you set spending limits. And if you’re splitting expenses with friends, the app does the math for you, ensuring everyone pays their fair share. If you’re serious about keeping your finances in check, get your hands on Rydoo.

Pros

- Efficient tracking of expenses in detail

- Convenient receipt scanning using mobile devices

- Easy reporting of expenses

- Smooth handling of multiple currencies

Cons

- Occasional software lag

- Incomplete information retrieval in the mobile app at times

Price: Free; Subscription: $8/month onwards

Expense Recorded

Say goodbye to the hassle of searching everywhere to manage your money and investments. With lots of good apps, managing your finances is now simpler. Tell us which app from our list of the best expense tracker apps for iPhone and Android worked for you. Did we miss your favorite app? Share in the comments!

Last updated on 23 November, 2023

The above article may contain affiliate links which help support Guiding Tech. However, it does not affect our editorial integrity. The content remains unbiased and authentic.